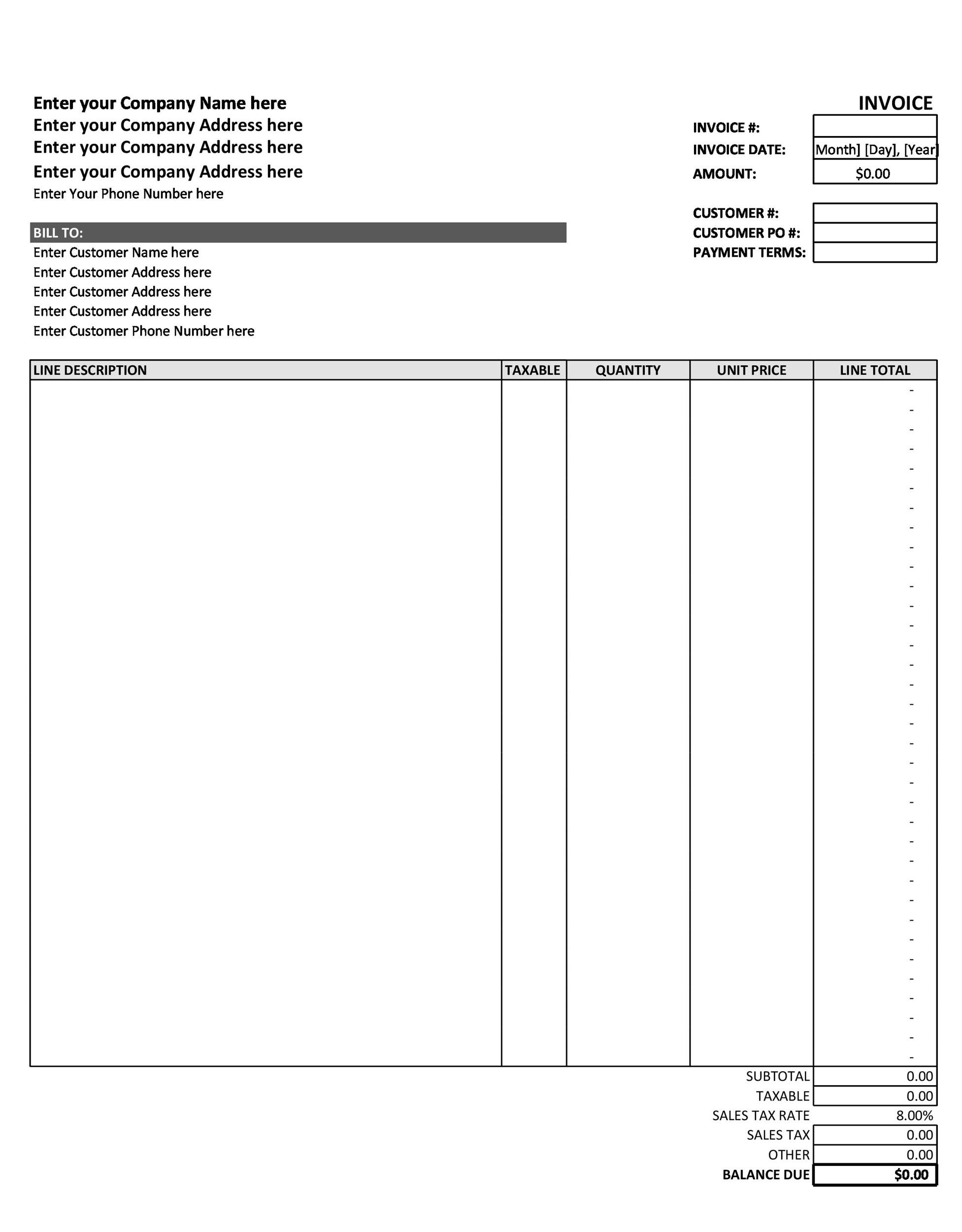

Or a statement that GST has been included in the final price.Īdding purchase order details to your invoice the GST and the total amount payable for the supply.if you charge an hourly rate, add the time you took to give the service.the amount, excluding tax, charged for the supply.the quantity or volume of the goods and services supplied, eg hours of physiotherapy, number of photocopied pages of a report.a description of the goods and services supplied.the correct service codes (using the wrong ones will hold up your payment).the name (or trade name) and GST number of the vendor (if applicable).the words ‘tax invoice’ as a heading (if you’re claiming GST).They take longer to process and you don’t get paid as quickly.Īll invoices need to meet the Inland Revenue tax invoice standards and include: If you can’t submit your invoices through one of the online services, you can post them to us. We may ask to see them to validate your claims and services provided, so make sure to keep copies of these on file.

If you invoice online, you don’t have to send the printed schedule or copies of referral forms and approval letters. Getting set up online Schedules, referrals and approval letters Our online systems are easy to use and you’ll get paid faster than doing it manually. You can submit invoices online and keep track of them using our eBusiness Gateway or your practice management system (PMS). For treatment injury claims, it’s the date the treatment injury was determined. We generally expect providers and suppliers to invoice us within two month of the date of service.Īll invoicing must be submitted to us within 12 months of the service you’ve provided.

0 kommentar(er)

0 kommentar(er)